We facilitate our customers achieve Financial Liberty, enabling them to do away with financial constraints and empower them to superintend credit with ease and simplicity, at their disposal.

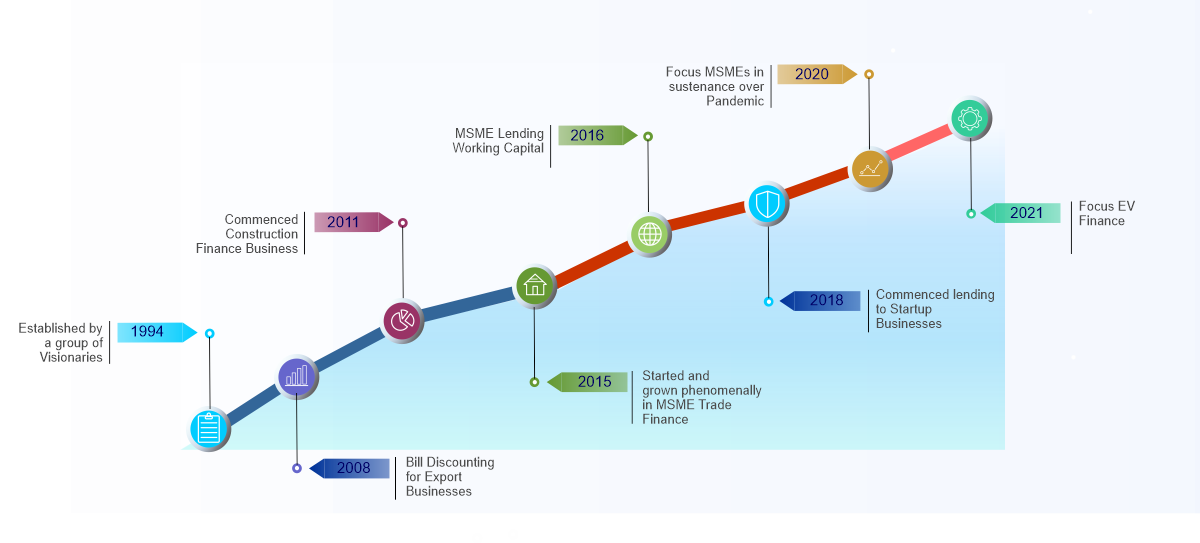

Cicago, being a Non-Banking Financial Company (NBFC) has commendable loan book served from various

business touch points across the country. Cicago in its continued efforts is in the parth of achieving,

its Vision since it’s registration with the Reserve Bank of India.

Cicago Finance has prodigiously handled the working

capital and business lending needs of small businesses in the MSME sector.

To be a respected and inspiring financial institution by all fairness, responsible approach and quality service that’ll create long-term value for all of our stakeholders.

Impact the lives of millions of Indian Micro, Small, and Medium-sized business consumers through sustainable financing solutions.

To make a significant difference in the lives of millions of small businesses. Cicago would always maintain high standards of ethics and openness in all its dealings.

A Core Team that Manages Cicago's business is also the members of the Board, thus enabling critical decisions are never delayed. With years of experience in NBFC business, they are supported by an Advisory Board that consists of Industry Experts.

Chairman & Chief Executive Officer

Amol carries decades of experience in Financial Sector especially on Lending Objectives. Cicago's customers relationships are built over trust and past performance which Amol takes pride in.

Amol actively manages his team that handled Investor Relations and Regulatory Objectives. He also managers Core Analytics that indeed help ensure Investors interest is kept as priority.

Amol's innovative lending solutions within Regulatory Framework were unique and were profitable to both investors and our MSME Clients.

Director and Chief Operating Officer

Shital drives our Operations that handles entire Lending Operations and oversees business operations that include loan booking, funding, research and maintenance, payments, advances and terminations.

Shital is actively manages in Human Resources, Policies, and Guidelines for Operations. He also manages Risk control processes and operation Business Models.

Cicago's is instrumental in managing highly regulated opertions that can scale up without change in internal processes.

When we look back to list down our achievements we only notice how we helped our clients achieve their business growth objectives. We also learned more about challenges that the modern financial era has never seen, such as Pandemic. Today we experience a sense of achievement when clients proudly speak about their achievements/milestones.

Copyright Cicago. All rights reserved